What's Emerging In Emerging Markets

- rickstine

- Jan 21, 2021

- 1 min read

Emerging markets have been on a tear this year.

The MSCI EM ETF is up about 9% on the year, with only 6 of 26 countries that make up the index showing negative returns (three of those countries are from South America - Argentina, Brazil and Peru.) Powering the gains have been strong returns from Asia (with the exception of Malaysia).

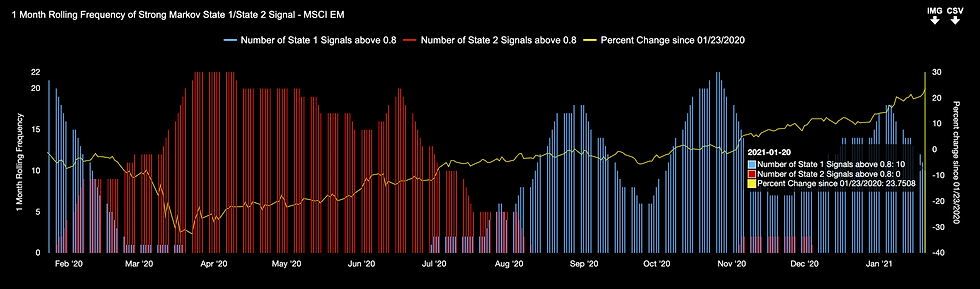

So, where do we go from here? At Excalibur Pro, we look at technicals and momentum and right now, both of those are suggesting some weakness ahead or at least a slowdown in the growth of positive returns for the MSCI EM ETF. Using the Markov Process to check in on momentum, we are seeing a slowdown in bullish signals. One of our measures to smooth volatile Markov data is to look at the number of days over the past month (defined as 22 days) where Markov values have been at 0.8 or above (very strong signals). At the beginning of January, we had 18 of the last 22 days having Markov values above 0.8. But since then, the number has begun to decline. As of Jan. 20, that number slipped to 10 of the past 22 days.

The current price has been well above its 50-day, 100-day and 200-day moving averages since late October. And the Relative Strength Index is around 73 - above the 70 score that usually indicated an overbought state.

ความคิดเห็น